We Know, Debt Doesn’t Sound “Flexible”

We all know what debt is: money that is lent and must be repaid with interest. But in terms of debt as a funding model for growing SaaS companies, it’s actually a quite flexible financing option for many reasons. When compared to other models that require collateral (that online software-based companies typically don’t have) or a fair amount of equity in exchange for capital (which limits decision-making and operational control), it quickly stands above the rest.

We all know what debt is: money that is lent and must be repaid with interest. But in terms of debt as a funding model for growing SaaS companies, it’s actually a quite flexible financing option for many reasons. When compared to other models that require collateral (that online software-based companies typically don’t have) or a fair amount of equity in exchange for capital (which limits decision-making and operational control), it quickly stands above the rest.

Before we dig into the benefits of debt, keep this in mind: every business is different. Your structure, needs, and overall goals may support and fully justify one form of funding over another. It is up to business owners and leaders to weigh the pros and cons of different working capital providers and make a decision from there.

Flexibility and Ownership Go Hand-in-Hand

One of the greatest flexible financing benefits of debt is that it keeps you in complete control of your business. If you’re raising venture capital, this might not sound like a significant trade-off. You get the capital you need in exchange for something that wasn’t really doing you any good, right? You couldn’t be more wrong.

Having complete ownership and being able to exercise the decision-making authority that comes with it is critical to a growth stage SaaS company. With equity, you have to work with your investor if you decide to take your business a certain route, choose a specific vendor over another, purchase equipment or other capital needs, or choose the candidates you want to hire.

Well, that’s just part of the relationship and agreement. Capital for equity. But with debt financing, the agreement provides capital now for a return later. This is where many companies get stuck: why go into debt when it’s just going to cost you more in the long run? Because equity is more valuable than a lender’s return via interest rate on a loan. More on this shortly. But the point here is that when you own the business, you own the options.

Flexible Financing Provides Collateral Convenience

Venture capital investors require a portion of your equity. Banks and other investors require collateral. As a growing SaaS company, what collateral do you have? There’s very little in terms of equipment and property. That’s why debt financing lenders typically use intellectual property as collateral rather than hard assets.

“Pause — intellectual property? That’s the entire foundation of my business! My idea!”

Yes, we get your reservation. IP is the foundation of your entire platform. But consider whether you’d be going into debt in the first place if you wouldn’t be able to uphold your obligation. Consider also that debt financing lenders, like other financing providers, have a due diligence process. A loan can’t and won’t be extended to a business if it’s not in a strong enough position to assume that obligation.

By virtue of qualifying, you shouldn’t be worried because that means the lender isn’t worried. And if there are some concerns, they’d be discussed upfront prior to the loan being issued and would need to be resolved to receive the funding.

Additionally, by using IP as collateral rather than assets or equity, you continue to lead the charge toward your goals. Simply make your payment per your agreement, and you’re set. Keep in mind that your loan is a negotiable arrangement. Many aspects of your debt financing can be negotiated and customized, allowing you to focus on growth and profit while making payments that don’t leave your business strapped.

Ultimately, being able to use IP over equity and assets means you continue to enjoy the freedom you’ve been enjoying as a business owner and leader while receiving the capital you need to achieve your goals. No interference, countered decisions, or hassle.

The End Result is Better

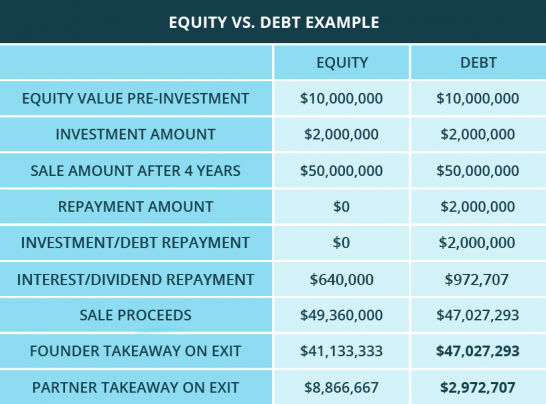

Remember when we said equity is more valuable than a lender’s return via interest rate on a loan? Let’s dig into that. VCs will take anywhere from 15–30 percent of your business in exchange for capital. That’s significant. It might not sound like a big trade-off, but take a look at this. Based on a SaaS company’s current value of $10 million and a $2 million investment, here’s what the overall takeaway for you as a business owner might look like four years down the road upon a sale of the business for $50 million.

River SaaS Capital’s Flexible Financing Can Help You Grow

River SaaS Capital is made up of a team of expert SaaS lenders that value the freedom and individuality of our partners. Our flexible alternative venture debt financing solutions are customizable to help you reach your unique goals and visions. If you’re interested in learning more, check out our debt financing solutions page.

Ready to partner with us or have any questions for our team? Fill out the form below and a funding expert will respond to you shortly.