Debt Funding Overview

Debt Funding Solutions for SaaS

Debt funding allows fast-growing SaaS companies to obtain working capital, even if they do not have traditional assets as collateral to borrow against. It can be used on its own by companies who are self-funding their growth or used to complement equity-based venture capital investments at various stages of a company’s growth.

In the case of startups that lack both assets and positive cash flow, debt providers often combine their loans with agreements known as warrants that also give them the right to purchase equity in order to protect themselves in the case of default.

When used as an alternative to traditional equity-based venture capital financing, debt financing allows entrepreneurs to obtain the working capital they need to grow their business — without giving up ownership in their company in the process.

As a complement to equity-based financing, debt financing can provide growth capital to extend the cash runway of a startup company in between equity funding rounds. This allows a company to achieve key milestones, demand higher valuations, and minimize equity dilution.

SaaS Debt Funding vs. Equity Funding: An Illustration

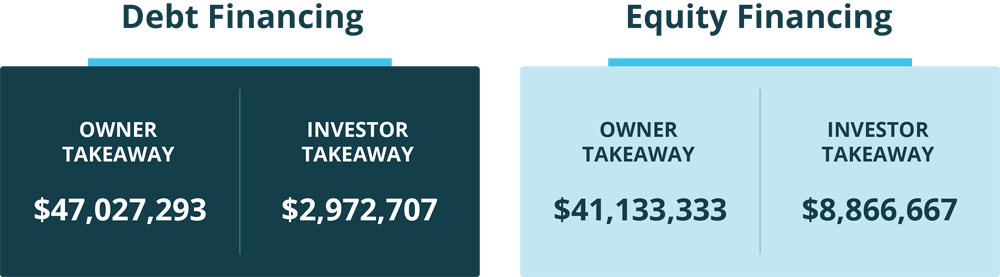

While equity can be an attractive form of startup financing from a cashflow perspective, it can have material financial ramifications at exit.

How Our Debt Funding Is Different

River SaaS Capital’s origins lie in providing venture debt financing to SaaS companies, particularly those who are generating cash in the form of recurring revenue but simply lack the assets to use as collateral for a bank loan. Recurring revenue and other key indicators are validated to understand a prospect’s capacity to support the debt.

We focus heavily on helping growth-stage SaaS companies who have strong products but are not yet profitable and are not generating the kind of recurring revenue numbers that make them attractive to other providers of debt or equity financing.

We pride ourselves on our ability to grow with our borrowers over time, with the ability to provide up to $4M of either debt and/or equity to established borrowers.

“We appreciate their flexible structure and ability to invest with us over time.”

Michael Anderson

CEO, Etail Solutions

Frequently Asked Debt Funding Questions

Who is River SaaS Capital?

River SaaS is a provider of alternative venture financing to early-stage SaaS companies throughout the U.S. Our management team has more than 100 years of combined lending, credit and operations experience. Along with our knowledge of and passion for technology, we have the precise blend of talent to help early-stage technology companies grow their business. Proudly based in Cleveland, Ohio, we offer alternative financing models, entrepreneurship mentoring and a long-term, partnership-based approach.

What types of companies do you fund?

Our financing model is best suited for software and technology-based companies that market their products using the software-as-a-service (SaaS) model. These high-growth, high-margin companies are well-suited to debt financing options, which allow them to preserve equity while still raising working capital.

What is your geographic focus?

We provide debt financing for SaaS companies in the U.S. only.

What is your due diligence process?

Our process starts out with a comprehensive list of questions that focus on the borrower’s technology and product offering, management team and business plan. We review historical financial statements as well as projections for the next 24 to 36 months, and we analyze the borrower’s current customer contracts to make certain they have subscription-based revenue spread over multiple customers. We then evaluate the sales process and meet with company executives to verify their experience and ability to grow and scale the business.

Do you require venture backing or warrants to be considered for financing?

We do not require venture backing to qualify. Regarding warrants, our SaaS financing is offered in many structures, including those with and without warrants. Learn more about our debt financing advantages here.

Is there a minimum or maximum financing amount?

We typically lend between $500K – $1.5M (or around 4x MRR) to qualified new borrowers but have the flexibility to fund up to $5M to established borrowers (via either debt and/or equity).

What is the minimum amount of ARR or MRR needed to be considered for a loan?

Ideal portfolio borrowers will have a minimum of $150K in monthly recurring revenue or $1.5M in annual recurring revenue, below the revenue sweet spot of traditional venture debt and debt-based alternative finance providers.