5-Minute Read

How You Want to Grow Determines Which Way You Go

SaaS companies looking to take their businesses to the next level may one day find themselves at a financial crossroads. In one direction, you have venture debt financing. In another, you have equity financing. Other options include angel investors and self-funding. Bank loans are an option, too, but they’re often more difficult to obtain due to the requirement for assets as part of the loan agreement.

SaaS companies looking to take their businesses to the next level may one day find themselves at a financial crossroads. In one direction, you have venture debt financing. In another, you have equity financing. Other options include angel investors and self-funding. Bank loans are an option, too, but they’re often more difficult to obtain due to the requirement for assets as part of the loan agreement.

Likely, the decision on what source to go with will come down to equity vs. debt capital, with your growth goals guiding where you go. These are two great options for obtaining funding for growth, but each has specific requirements, benefits, and risks that have far-reaching effects. If you’re a growing SaaS company, it’ll be important to carefully consider each one so you understand what to expect now and down the road. If you’re unfamiliar with either, you can learn more about them here. In this post, we’ll take a look at a financial scenario comparing the two with callouts of the key risks and benefits.

Already know the ins and outs of equity vs. debt funding? Our team is here to help.

Equity vs. Debt Capital Comparison Scenario

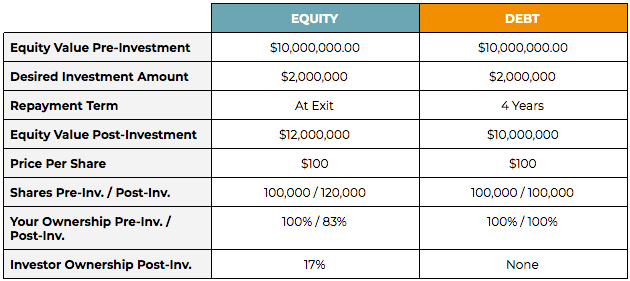

Below is a top-to-bottom breakdown in which two SaaS companies that a) have been around for some time and b) have achieved strong monthly recurring revenue (MRR) decide to explore equity vs. debt capital options. Once funding is obtained, the equity-side business owner loses 17% of their ownership stake due to dilution but only has to repay the investment on exit. The debt-side owner loses no ownership but has a set repayment term.

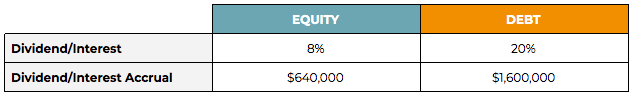

On the equity side, the business owner must pay a dividend to other shareholders, while the debt-side business owner must pay interest on the loan he received. The figures below show the totals of these amounts over time. At this point, the companies continue operations as normal. However, the equity-side business owner must consider their investor’s opinions and decisions, as the investor now owns a stake in the company and likely occupies a board seat. The debt-side business owner has no obligation to do similarly, though they must repay the debt as outlined in their lender’s loan agreement.

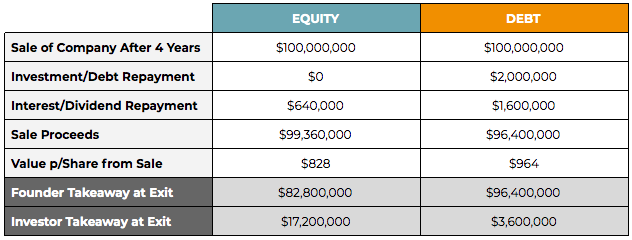

For the sake of this example, let’s say the equity-side investor decides to sell the company after four years — the same time at which the debt-side business owner has completed their repayment obligation. Both business owners have managed their companies well and achieved certain goals that led to a sale price of $100,000,000. When selling, the equity-side business owner has no debt to repay but must issue out dividends (assuming they are required). The debt-side company must repay the debt obligation plus interest (note that repayment has been ongoing throughout the past four years or based on the terms set in the agreement).

While the equity-side owner has higher sale proceeds, their stock price is a bit lower than the debt-side business owner due to dilution. When the deal is done, the equity investor takes their share appropriate for their ownership stake, amounting to slightly more than $17 million — leaving the equity owner with close to $83 million in takeaway proceeds. The debt lender, having been repaid the principal of their loan as well as interest, is satisfied in full for $3,600,000, leaving the debt-side owner with a much higher takeaway of $96 million.

Important Equity vs. Debt Capital Considerations

While the debt-side scenario seems to be the most immediately favorable, certain assumptions have been made in this comparison. First, we’re assuming the company made its debt payments on time throughout the life of their loan without any issues. Second, each company chose its preferred funding option for different reasons.

For example, say the equity-side owner wanted access to its investor’s contacts and also wanted to involve them in the company’s direction. Equity investors are experienced in their areas of focus (e.g. technology, SaaS, etc.) and are outstanding for making introductions and providing advice. Many of these benefits are available on the debt side, but because no ownership stake is taken, direction remains fully in the hands of the company owner. On the debt side, the owner remained completely free to steer his company along the course he chose. He assumed more risk with the debt, but he gained more freedom in the process. The equity investor had freedom from the start but had another perspective to consider.

Which Option is Right for Your Business?

At River SaaS Capital, we understand that equity vs. debt capital is an important decision. We also know you want options. That’s why we offer both equity and debt capital funding for SaaS companies. Why rely on two separate organizations to provide you with insight into their funding products only to have to take one’s word over the other as to which is best? Both of our funding options are available to you depending on your short- and long-term goals.

For example, if you’re looking for a lower cost of capital for startups, venture debt is often the best way to go long-term (as this scenario explained). But, if you’re looking for operational funding to maintain your organization as you scale up or have already utilized debt financing, SaaS equity financing may be the better route for you.

Regardless of the direction you choose, both equity and debt capital are available to you at River SaaS Capital. Many of our portfolio companies utilize both, as venture debt is often used earlier to accelerate sales and marketing efforts toward growth followed by equity financing for maintaining operations as progress toward specific objectives is made.

Whatever your path, know that River SaaS Capital is here to help you. Your success is our success, and we’re committed to helping you achieve your goals. If you’d like to learn more about the options available to you at River SaaS Capital, fill out the form below. If you’re ready to put our growth capital solutions to work for your business, apply quickly and easily online.